We Reviewed the Best Event Payment Platforms for Seamless Transactions

Managing payments is crucial for any event’s success.

The right event payment processing platform can streamline transactions, boost security, and enhance the attendee experience… but with dozens of popular options all claiming to be the right solution, how do you choose?

This list from EventsAir explores top event payment platforms designed to handle various aspects of event finances. Whether you’re organizing a conference, fundraiser, or festival, you’ll find a solution that fits your needs.

What Are Event Payment Platforms?

Event payment platforms, also called event payment gateways, are digital tools that process financial transactions for events.

They process everything from ticket sales and registration fees to donations and merchandise purchases, ensuring secure and efficient transactions. These platforms often support various payment methods, including credit cards, digital wallets, and mobile payments for easy online and in-person payments.

By using a reliable payment gateway, organizers can:

- Keep transactions secure: Payment gateways use encryption and PCI compliance to protect financial data.

- Offer payment options: Supporting multiple payment methods, from mobile to credit cards, improves attendee satisfaction.

- Manage money efficiently: Real-time payouts and detailed reports help organizers track and handle funds easily.

- Increase transparency: Automated processing provides clear reporting and analytics, giving organizers a real-time view of their revenue.

Platforms like EventsAir combine secure payment processing with comprehensive event management, letting organizers focus on creating great experiences. This also provides a heightened experience for all attendees and ensures they can make their payments securely –

Top Event Payment Platforms for Seamless Transactions

1. EventsAir Pay

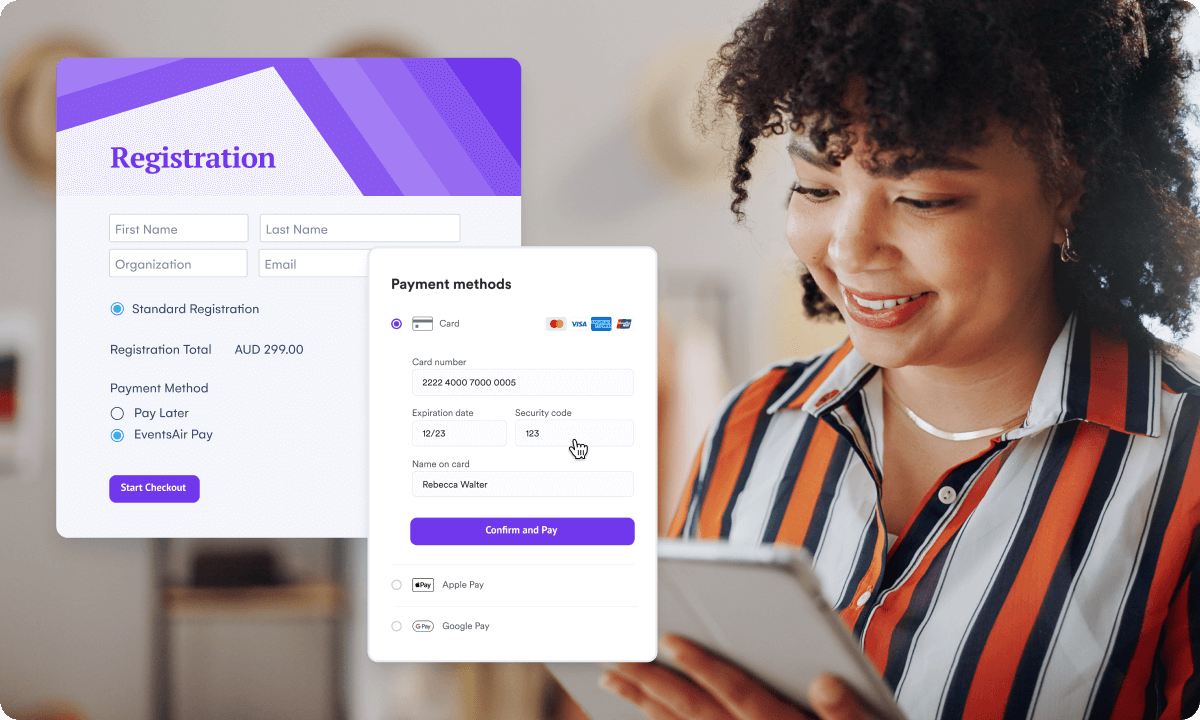

EventsAir Pay is a comprehensive event payment solution built into EventsAir’s end-to-end event management platform.

EventsAir Pay is deeply integrated into our event management platform, powered by partnerships with industry leaders Airwallex and Stripe. This seamless integration means you get enterprise-grade payment processing that works as a natural extension of EventsAir – no clunky third-party add-ons or manual connections required. And, with EventsAir Pay powered by two global leaders, this also means international event payments are handled accurately.

EventsAir Pay supports a wide range of payment methods, including:

- Mastercard

- Visa

- American Express

- WeChat Pay

- UnionPay (银联)

- Apple Pay

- Google Pay

All payments and registrations are automatically recorded in EventsAir—they flow naturally into your registration sites, mobile apps, budgeting tools, and other platform features. This means no manual data entry and real-time visibility across your entire event.

Pros

- All-in-one platform eliminates the need for third-party payment tools.

- Supports a wide range of global payment methods, enhancing attendee convenience.

- PCI-compliant with advanced fraud prevention for secure transactions.

- Real-time issue resolution with 24/7 dedicated customer support.

- Robust multi-currency support with automatic conversion for international events.

Cons

- Only available with an EventsAir subscription.

Want a hassle-free payment experience? Request a demo and see how EventsAir can transform your event payment process!

2. PayPal

PayPal is a widely recognized name in online payments. Its global reach makes it ideal for handling international event payments smoothly.

The platform offers features like multi-currency support and mobile payments, which ensure attendees can complete transactions easily, whether online or in person. PayPal also provides robust security features that protect every transaction.

However, its transaction fees can be relatively high, especially for smaller events.

PayPal Fees

PayPal’s fee structure typically includes:

- Standard Transaction Fee: 2.9% + $0.30 per transaction.

- International Transaction Fee: Additional 1.5% for cross-border payments.

- Chargeback Fee: $20 per instance.

- Refund Fee: No fee to refund a transaction, but the original transaction fee is not returned.

Pros

- Global brand recognition increases attendee trust and payment conversion.

- Robust multi-currency support with automatic conversion for international events.

- Seamless integration with mobile devices ensures smooth user experience.

Cons

- High transaction fees, especially for international and low-margin events.

- Limited customization of the payment flow can hinder brand consistency.

- Customer support can be slow, especially for chargeback disputes.

3. Stripe

Stripe is perfect for tech-savvy event organizers who need flexibility. Known for its powerful API, it allows users to create highly customized payment gateways. The platform supports multiple currencies, real-time payouts, and various payment methods.

Stripe’s comprehensive documentation makes integration easy for developers. However, it might require technical expertise to fully unlock its potential.

Stripe Fees

Stripe’s pricing model generally includes:

- Standard Transaction Fee: 2.9% + $0.30 per successful card charge.

- International Card Fee: An additional 1% is charged for cards issued outside the US.

- ACH Direct Debit: 0.8% per transaction, capped at $5 (for transactions ≥ $625).

Pros

- Advanced API allows for highly customized payment gateways and workflows.

- Supports a wide range of payment methods, including ACH, Apple Pay, and Google Pay.

- Real-time payouts and detailed analytics for efficient financial management.

Cons

- Requires developer expertise for setup and integration, limiting usability for non-technical teams.

- Higher fees for international transactions and certain payment methods.

- API complexity may introduce longer implementation times for non-standard event setups.

4. Eventbrite

Eventbrite is a popular all-in-one platform for event ticketing and payment processing. It handles everything from ticket sales to secure transactions through its built-in payment system.

The platform offers mobile-friendly payment options and detailed reporting tools. This makes it easy for organizers to track revenue. However, Eventbrite’s transaction fees can add up, particularly for smaller events.

Eventbrite Fees

Eventbrite’s fee structure typically consists of:

- Payment Processing Fee: 2.5% + $0.99 per paid ticket.

- Service Fee: Ranges from 3.5% to 5.5% of the ticket price, depending on the package.

- Payment Processing for Free Tickets: 2.5% + $0.99 per order.

- Refund Fee: No additional fee, but original fees are not refunded.

Pros

- All-in-one event management platform with built-in ticketing and payments.

- Mobile-friendly interface and payment processing, enhancing the attendee experience.

- Extensive reporting features help track revenue and attendance trends in real time.

Cons

- Transaction fees can accumulate quickly, especially for high-volume, small-ticket events.

- Limited customization in the checkout process, which may not meet branding needs.

- Best suited for small to mid-sized events, lacking scalability for larger, complex events.

5. Authorize.NET

Authorize.NET is a trusted payment gateway that provides enterprise-grade security through its three-tier architecture. It’s fully supported by EventsAir and offers robust features for handling event payments securely.

The platform supports various payment methods including credit cards, digital wallets, and eChecks, making it versatile for different event types. Its hosted payment solution adds an extra layer of security while maintaining a smooth checkout experience.

Authorize.NET Fees

- All-in-one: Payment gateway + merchant account + eCheck ($25/month, 2.9% + 30¢ per transaction)

- Payment gateway & eCheck: For existing merchant accounts ($25/month, eCheck 0.75%, credit cards 10¢ + 10¢ batch fee)

- Payment gateway only: For existing merchant accounts ($25/month, 10¢ per transaction + 10¢ batch fee)

- Merchant account required: To effectively use Authorize.NET, event planners will also require a merchant account

Pros

- Three-tier payment architecture for enhanced security.

- Seamless integration with EventsAir.

- Comprehensive fraud detection tools.

- 24/7 human support.

Cons

- Setup process requires technical knowledge.

- Additional fees for certain advanced features.

Conclusion

Choosing the right event payment platform is crucial for your event’s success. While platforms like PayPal, Stripe, Eventbrite, and Authorize.NET offer various features, each has limitations.

EventsAir stands out as a comprehensive solution. It offers:

- Advanced payment processing

- Real-time payouts

- Detailed analytics

- PCI-compliant security

- Support for in-person, virtual, and hybrid events

- Powerful event management tools for marketing, accounting, registration & check-in, and more

For event organizers seeking an all-in-one platform that simplifies payments and enhances overall event management, EventsAir is the clear choice.

Ready to streamline your event payments? Get started by booking a demo.