How we optimize event budgeting for planners & organizers

Planning an event, whether it’s a small corporate meeting or a massive trade show, often begins with budgeting. Your event budget not only dictates the feasibility of the event but also plays a huge role in its eventual success (or failure).

Effective event budgeting keeps your finances in check and gives you a clear financial roadmap to follow as you move through the planning and execution stages. And, in this EventsAir guide, we’re sharing our process for creating event budgets that work.

What is event budgeting?

Event budgeting involves planning and controlling the financial aspects of an event like:

- Estimating costs

- Allocating funds to different event components

- Tracking expenses

- Ensuring everything stays within budget

An effective budget is a roadmap that guides you through each phase of planning and execution without (too many) unwelcome surprises. It also helps you cultivate a realistic, achievable, and cost-effective vision for your event.

The importance of effective event budgeting

Event budgeting is the cornerstone of successful event planning. Without a well-constructed budget, even the most creative and ambitious event ideas can fall flat. Here’s why effective event budgeting is crucial:

- Financial Control: Keeps spending within set limits.

- Resource Allocation: Directs funds to high-impact areas.

- Risk Management: Prepares for unexpected expenses.

- Vendor Management: Facilitates better deals and timely payments.

- Post-Event Analysis: Helps evaluate and improve future budgets.

7 Steps to effective event budgeting

Step 1: Define your goals and objectives

Outline what you want to achieve with your event to allocate your budget more effectively. For example, if you’re planning a corporate seminar to educate your clients about a new service, then your primary goals might include:

- Generating 50 qualified leads

- Educating 100 attendees about the new service features

- Achieving a 90% attendee satisfaction rate

Achieving these goals will require a plan, and executing that plan will require a budget.

Step 2: Determine your total budget

Your total budget is an important financial boundary for your event. It’s the number that defines your upper limit in terms of what you can spend, and pinning it down usually involves a number of stakeholders.

When you enter these negotiations, you need two things:

- A clear vision for the event

- Data (from past events or initial quotes) to back up your budget request

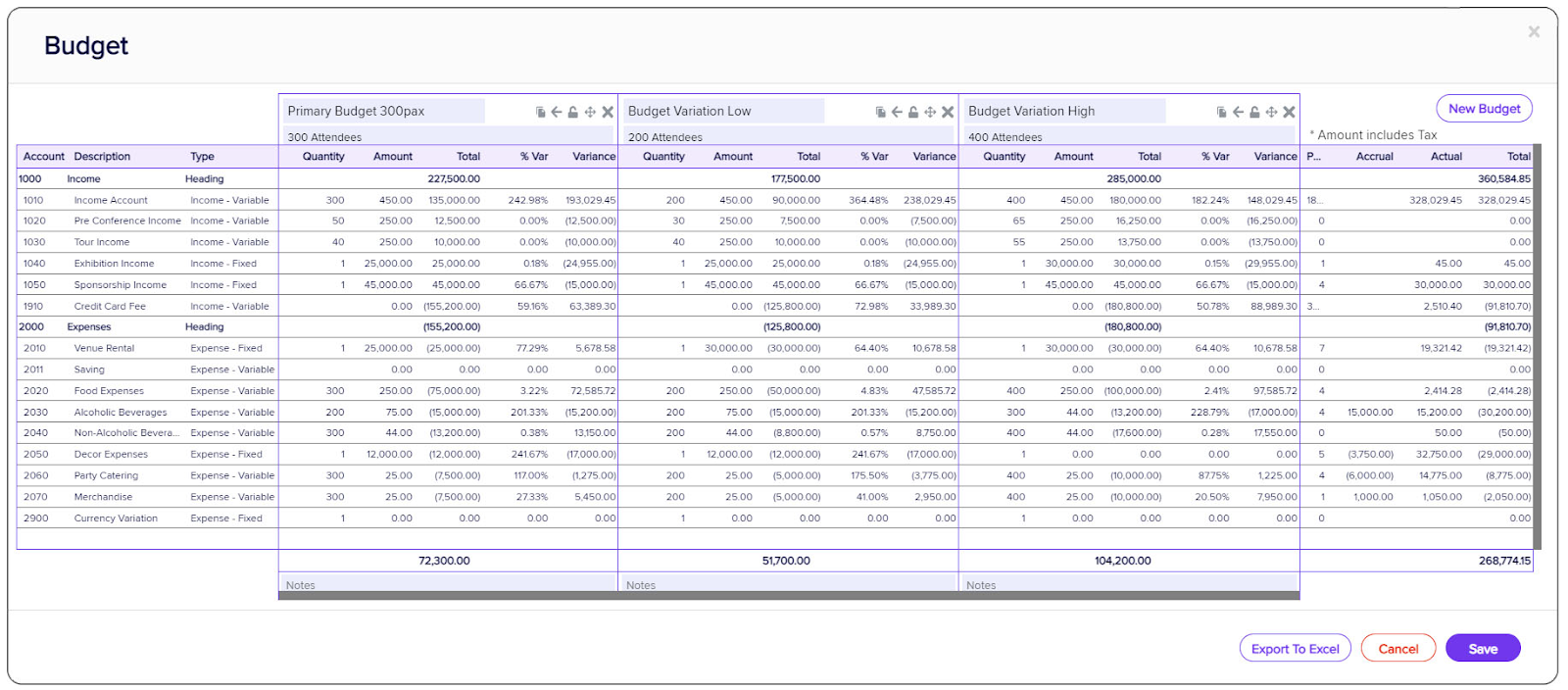

At this stage, we recommend creating and comparing multiple budget scenarios to explore important “what if” scenarios. Typically, three is a good number to aim for—a high budget, low budget, and middle-ground budget. This gives you some flexibility to adapt on the fly (and makes the conversation more collaborative).

If you use an event management platform with built-in accounting tools, it should give you the option to create these variable budgets.

Step 3: List all expense categories

Now that you have your total budget, it’s time to break it down into specific expense categories. Start with major expense categories:

- Venue rental

- Catering

- Audio/Visual equipment

- Marketing and promotion

- Staffing

- Entertainment

- Transportation

- Event software

- Decorations

- Miscellaneous (permits, insurance, etc.)

Then divide each major category into subcategories. For example:

- Catering:

- Food

- Beverages

- Service staff

- Equipment rental

Being comprehensive is the name of the game here. So, make sure you consider your event’s unique requirements—for example, hybrid events will likely incur live streaming costs, while outdoor events need to budget for weather contingency plans.

Step 4: Allocate funds to each category

Based on your goals and the expense list, allocate a portion of your total budget to each category and prioritize essential items:

- Venue: Rental fees, utilities, setup, and cleanup

- Catering: Food, staff, and equipment rentals

- AV equipment: Sound systems, lighting, and projection

- Marketing and promotion: Advertising, ticketing, and merchandise

- Transportation: Shuttle services, parking, and logistics

- Staffing: Event coordinators, volunteers, and security staff

- Decorations: Floral arrangements, thematic decor and lighting effects

- Miscellaneous: Insurance, contingency fund, permits, and licenses

We always recommend allocating 5-10% of your budget to unexpected expenses. This gives you peace of mind when dealing with last-minute problems.

Step 5: Incorporate revenue streams

When you’re budgeting, don’t overlook income sources that can offset your costs:

- Ticket sales: Determine pricing tiers and projected attendance.

- Sponsorships: Develop packages at various levels with clear benefits.

- Exhibitor fees: If applicable, set rates for booth spaces or virtual exhibition spots.

- Merchandise: Consider event-branded items for sale.

- Additional services: Evaluate paid workshops, VIP experiences, or special sessions.

When calculating sponsorship fees, decide the percentage you want to take from your sponsor’s revenue as the fee. Then, calculate how many sales leads you should target and assign a price to each sales lead to estimate the potential revenue expected from the event.

Step 6: Monitor and adjust your budget

After setting your budget, continuously monitoring your actual expenses against your planned budget is crucial. Real-time tracking lets you catch discrepancies early and adjust to stay within your financial limits.

However, effective real-time monitoring can be a challenge—we recommend the following to help you stay on track:

- Choose event management software with integrated accounting. This means less double entry and more accurate tracking of expenses.

- Train staff in data management. Incorrect data entry is a major cause of budget discrepancies, so make sure your team knows how to input expenses accurately.

- Regularly review and analyze your financial data. This will help you identify any areas where you may be overspending and adjust accordingly.

Step 7: Conduct post-event financial analysis

Do a thorough post-event financial analysis to check how well you stuck to your budget. This includes comparing estimated costs with actual expenses and identifying areas where you spent more (or less) than you planned.

EventsAir provides over 150 pre-made reports, including breakdowns of income and expenses and customizable financial reports to suit your event’s specific needs. This makes it easier to analyze spending and measure event ROI.

Simplify event budgeting with EventsAir

Effective event budgeting is the backbone of successful event planning. By following the steps above alongside using EventsAir, you can stay within budget while delivering a memorable experience for attendees.

Ready to simplify event budgeting? Request a demo to see how EventsAir can help.