GATEWAYS

Secure payment gateways let you scale payments and reduce errors/refunds.

Payment gateways are shaping a world of seamless and secure financial transactions at events.

Features and benefits of payment gateways

Efficiently Process Transactions:

Payment gateways simplify transaction processing, allowing organizers to accept various payment methods. Attendees can conveniently use credit cards, debit cards, or digital wallets, ensuring a smooth payment experience.

Expand Global Reach:

These gateways facilitate transactions worldwide, broadening the event's audience and encouraging international participation, thus maximizing its impact and success.

Track Transactions in Real-time:

Organizers gain instant insights into transaction statuses, enabling informed decisions on resource allocation and strategy adjustments to optimize financial outcomes and overall event success.

Ensure Security:

Payment gateways implement robust security measures like encryption and tokenization, safeguarding sensitive financial data, thereby enhancing trust among organizers and attendees in the event's digital infrastructure.

Automate Refund Processes:

In cases of cancellations or refunds, payment gateways streamline the process, ensuring prompt transactions, which adds convenience for both attendees and organizers, ultimately contributing to their satisfaction.

Risks Associated with Gateways

Address Technical Glitches and Downtime Promptly:

Event organizers must have contingency plans in place to address technical issues swiftly, minimizing disruptions to the payment process and ensuring seamless attendee experiences.

Invest in Cybersecurity Measures:

Given the potential cybersecurity threats, organizers should invest in robust measures to protect attendee information from breaches, thus safeguarding the integrity and reputation of the event.

Factor Transaction Fees into Budget:

While payment gateways offer convenience, organizers need to consider transaction fees and budget accordingly to avoid unforeseen financial burdens, ensuring effective financial management throughout the event.

Benefits for Event Planners & Organizers

Increase Sales with Diverse Payment Acceptance:

Payment gateways accommodate various payment methods, enhancing sales opportunities and contributing to the event's overall financial success.

Simplify Financial Management:

Organizers benefit from streamlined financial processes, with transaction data readily accessible for analysis, thus minimizing manual efforts and potential errors.

Facilitate Convenient and Secure Transactions:

Attendees enjoy convenient and secure payment experiences, allowing them to focus on enjoying the event rather than navigating complex payment processes, thus enhancing overall satisfaction and engagement.

Benefits for Event Attendees & Delegates

Enjoy Convenient and Contactless Transactions:

Attendees experience the ease of contactless transactions through payment gateways, aligning with current health and safety preferences, thus minimizing physical contact and enhancing peace of mind.

Trust Secure Transactions:

Payment gateways prioritize data security, ensuring attendees' financial information is protected, thus fostering trust and confidence in using digital payment methods at events.

Experience Efficient Refund Processes:

In cases of cancellations or refunds, attendees benefit from automated and expedited processes, resulting in hassle-free transactions and contributing to overall satisfaction, even in unforeseen circumstances.

Decision-Making Framework for Gateways

Cost Analysis

- Choose a payment gateway with competitive fees.

- Compare fees against projected transactions.

- Assess upfront or set-up costs for each gateway.

- Investigate extra charges (international transactions).

Risk Analysis

- Evaluate encryption, tokenization, and compliance.

- Research gateways' history of data breaches.

- Consider reliability in case of glitches or downtime.

- Opt for gateways with a proven track record.

Impact Assessment

- Assess user experience (organizers and attendees).

- Evaluate handling of international transactions.

- Check if the gateway allows custom branding.

- Select a gateway that can grows with the event(s).

Time/Effort Investment

- Evaluate the time and effort needed for integration.

- Consider support needs, especially during integration.

- Opt for a gateway with a quick integration process.

Popular Payment Gateway Snapshots

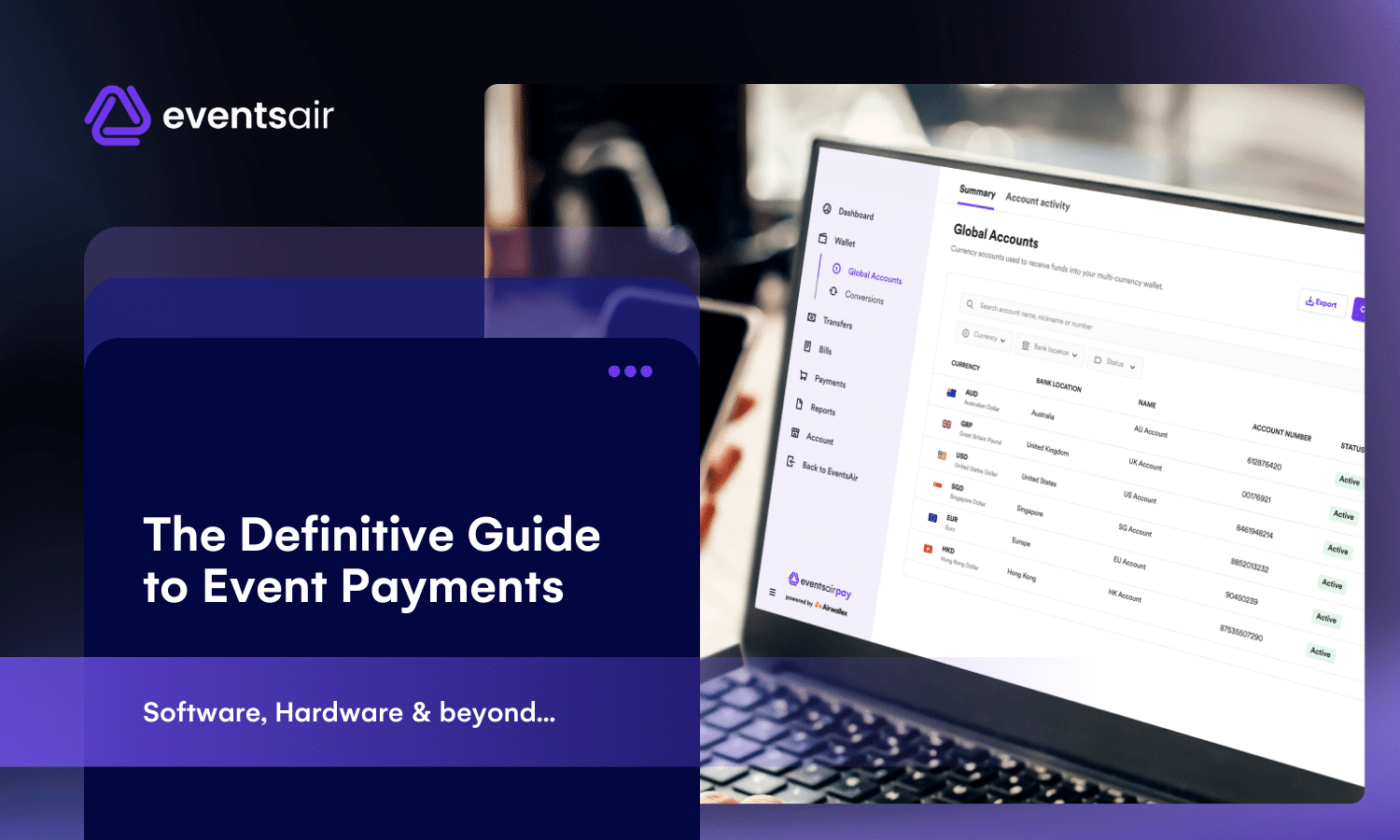

EventsAir Pay

Key Features:

- Powerful, sophisticated and secure integration.

- Real-time issue resolution.

- Supports multiple payment methods (credit cards, digital wallets,etc.).

Event Payment Suitability:

- Seamlessly embedded within your event registration page.

- Directly action reimbursements in the EventsAir platform.

Stripe

Key Features:

- Comprehensive set of APIs for customization.

- Support for multiple payment methods (credit cards, ACH, etc.).

- Advanced fraud protection and security features.

Event Payment Suitability:

- Ideal for events requiring flexibility in payment methods and customization.

- Suitable for conferences with diverse attendee locations.

Square

Key Features:

- User-friendly interface, suitable for small to medium-sized businesses.

- In-person and online payment processing.

- Square Reader for physical transactions.

Event Payment Suitability:

- Best for events with on-site payments and a need for quick setup.

- Great for trade shows and small to medium-sized meetings.

Braintree (Owned by PayPal)

Key Features:

- Robust payment gateway with international support.

- Accepts various payment methods.

- Advanced security features.

Event Payment Suitability:

- Suitable for events with a global audience.

- Ideal for conferences with diverse payment preferences.

PayPal

Key Features:

- Widely used and recognized payment platform.

- Supports international transactions.

- Easy integration with websites and apps.

Event Payment Suitability:

- Suitable for events with attendees familiar with PayPal.

- Ideal for online conferences and meetings.

eWay

Key Features:

- Customizable solutions for various business needs.

- Supports multiple payment methods.

- Offers fraud prevention tools.

Event Payment Suitability:

- Suited for events requiring tailored payment solutions.

- Good for conferences with diverse payment preferences.

AI Generated Gateway Comparisons

We asked AI to generate comparisons of popular payment gateways, to avoid bias or subjective opinion. It's important to consider your needs, compliance requirements and fee structure when selecting a gateway. Refer to vendor websites and policies for accurate information.

AI Compares: Stripe v Square

Important: this comparison was generated using AI and may not be an accurate portrayal of the vendors. It's critical to do your own research when it comes to payments and financial products.

AI Compares: Braintree v Paypal

Important: this comparison was generated using AI and may not be an accurate portrayal of the vendors. It's critical to do your own research when it comes to payments and financial products.

AI Compares: eWay vs SecurePay

Important: this comparison was generated using AI and may not be an accurate portrayal of the vendors. It's critical to do your own research when it comes to payments and financial products.

AI Compares: Pin Payments v Square

Important: this comparison was generated using AI and may not be an accurate portrayal of the vendors. It's critical to do your own research when it comes to payments and financial products.

AI Compares: Stripe v PayPal

Important: this comparison was generated using AI and may not be an accurate portrayal of the vendors. It's critical to do your own research when it comes to payments and financial products.

Popular Vendors

AI Generated Comparisons

HARDWARE AND DEVICES

Commercialize every event moment with scalable mobile payments

Payment devices are transforming the landscape of conferences, trade shows and events.

In the ever-evolving landscape of events, conferences, and trade shows, the integration of cutting-edge payments hardware and devices has become a game-changer. From streamlining transactions to enhancing overall attendee experience, these technological marvels are shaping the future of event planning. Let's delve into the benefits, risks, and the profound impact they have on both event organizers and attendees.

Benefits of payments hardware at events

Efficiency and Speed:

By accelerating transactions, payments hardware reduces queues and wait times at food stalls, merchandise booths, and ticket counters, ensuring attendees can make purchases swiftly.

Contactless Payments:

Integrating contactless technology enables quick and secure transactions via smartphones, smart cards, or wearables, promoting a seamless and hygienic payment experience for attendees.

Real-time Analytics:

Event organizers gain access to real-time transaction data, empowering them to analyze spending patterns, popular products, and peak hours. This insight enables informed decisions and optimization of event planning strategies.

Enhanced Security:

Advanced security features such as encryption and tokenization protect against fraud and data breaches, fostering trust among attendees and organizers in the integrity of the event.

Customization and Branding:

Payments hardware can be customized with branding elements, reinforcing the event's identity and serving as an additional marketing channel, enhancing overall engagement.

Risks associated with payments hardware

Technical Glitches:

The reliance on technology introduces the risk of technical malfunctions, such as connectivity issues or hardware failures, potentially disrupting the payment process and impacting attendee satisfaction.

Data Security Concerns:

Handling sensitive financial information poses a risk of data breaches, requiring robust security measures to protect attendee data and maintain trust in the event's integrity.

Initial Investment:

Implementing payments hardware requires a significant upfront investment, which organizers must carefully evaluate against potential benefits and revenue generation.

Hardware for event planners & organizers

Streamlined Operations:

Payments hardware streamlines ticketing, merchandise sales, and concession transactions, reducing workload on event staff and enhancing overall operational efficiency.

Increased Revenue Opportunities:

Quick and convenient transactions lead to increased sales, as attendees are more likely to make impulse purchases, contributing to higher revenue for event organizers.

Data-Driven Decision Making:

Real-time analytics offer valuable insights into attendee behavior, enabling organizers to optimize marketing strategies, plan future events, and tailor offerings to attendee preferences.

Hardware to enhance attendee experience

Convenience and Speed:

Attendees enjoy a hassle-free and quick payment process, enhancing the overall event experience and reducing time spent in queues.

Contactless and Hygienic Transactions:

Contactless payments align with health and safety concerns, enabling attendees to make purchases without physical contact, promoting a hygienic environment.

Personalized Offers and Loyalty Programs:

Payments hardware enables organizers to implement personalized offers and loyalty programs, fostering attendee engagement and loyalty based on spending behavior.

Modern payment technologies

Near Field Communication (NFC):

Allows users to make payments by tapping their cards or mobile devices on contactless-enabled terminals.

Mobile Wallets:

Apps like Apple Pay, Google Pay, and Samsung Pay enable users to store their card information securely and make payments using their smartphones.

QR Code Scanning:

Users scan QR codes to initiate payments, often used in mobile payment apps or for person-to-person transactions.

Bitcoin, Ethereum, and other Cryptocurrencies:

Digital currencies that use blockchain technology for secure and decentralized transactions.

Venmo, Cash App, PayPal:

Facilitate easy money transfers between individuals using mobile devices.

Fingerprint and Facial Recognition:

Biometric data is used for secure and convenient payment authorization.

Online Banking:

Traditional banking institutions offer online platforms for bill payments, fund transfers, and more.

E-Wallets:

Electronic wallets like PayPal, Skrill, and Neteller allow users to store funds and make online transactions.

Real-Time Payment Systems:

Systems that enable instant fund transfers between banks or financial institutions.

Tokenized Payments:

Replace sensitive payment information with unique tokens, enhancing security in transactions.

EMV (Europay, Mastercard, Visa) Chip Cards:

Enhanced security through embedded microchips in payment cards.

Virtual Assistants:

Users can make payments through voice commands using platforms like Amazon Alexa or Google Assistant.

Smartwatches and Fitness Trackers:

Devices equipped with payment capabilities for convenient transactions on the go.

Connected Devices:

Payments facilitated by interconnected devices, such as smart refrigerators or cars.

Who are the big thinkers in payment innovations, technology and security?

Shamina Singh:

LinkedIn: Shamina Singh

Expertise: Shamina Singh is the Founder and President of the Mastercard Center for Inclusive Growth. Her focus on inclusive growth and financial inclusion may provide perspectives on payment technology's role in diverse communities.

Vanessa Colella:

LinkedIn: Vanessa Colella

Expertise: Vanessa Colella was the Chief Innovation Officer at Citigroup and is now Global Head of Innovation and Digital Partnerships at VISA. Her role involves exploring innovative solutions, including those related to payment technology. She may provide insights into the evolving landscape of financial services.

Stacy Rosenthal:

LinkedIn: Stacy Rosenthal

Expertise: Stacy Rosenthal, the VP of Payments at PayPal, has experience in payments and financial services. Her insights may cover the intersection of technology, payments, and user experience.

Mark Horwedel:

LinkedIn: Mark Horwedel

Expertise: Mark Horwedel, the CEO of the Merchant Advisory Group, has a background in payments and frequently discusses topics related to payment technology, including hardware and industry trends.

Steve Mott:

LinkedIn: Steve Mott

Expertise: Steve Mott is the Principal at BetterBuyDesign, a consultancy focusing on payments and financial services. He has extensive experience in the industry and may provide insights into payment technology trends.

Rodney Joffe:

LinkedIn: Rodney Joffe

Expertise: Rodney Joffe is a Senior Vice President and Fellow at Neustar, and he has a background in technology, security, and payments. His insights may touch on the intersection of technology and financial services.

Payment Technologies

SUPPORT AND REFUNDS

Handling support, refunds and the logistics of taking payments

Expert strategies for support, refunds, and exceptional attendee experiences

Successful event planners excel in customer support, refunds, and ensuring exceptional attendee experiences by employing proactive strategies. By establishing clear policies, maintaining effective communication channels, and being prepared for unforeseen challenges, planners can build a resilient and positive reputation within the industry.

Implement a clear and fair refund policy

Considerations:

Establish a transparent refund policy upfront, clearly communicating terms and conditions, deadlines, eligible reasons, and the refund process.

How the best event planners do it:

- A well-defined refund policy sets expectations and minimizes disputes.

- Ensure accessibility on your event website and registration platform.

- Explicitly state refund circumstances, like event cancellation or attendee withdrawal, fostering understanding and acceptance among attendees.

First-class customer communication

Considerations:

Offer multiple support channels such as email, phone, and live chat during the event, staffed by a well-trained team equipped to handle various issues.

How the best event planners do it:

- Accessible and responsive customer support is crucial during events.

- Train your team to address diverse situations promptly and courteously.

- Consider a dedicated support area at the event venue for in-person assistance, enhancing attendee experience and issue resolution.

Plan for tech issues or glitches

Considerations:

Anticipate technical issues with ticketing platforms, payment gateways, or event apps, and have backup plans like manual check-ins ready.

How the best event planners do it:

- Despite preparations, technical glitches may occur.

- Communicate backup procedures clearly to your team for swift execution.

- Addressing tech challenges promptly demonstrates professionalism and prevents frustrations from escalating.

Be ready for last minute changes

Considerations:

Prepare for sudden schedule alterations or cancellations, promptly communicating changes to attendees with clear instructions for adjustments or refunds.

How the best event planners do it:

- Flexibility is crucial in event planning.

- Communicate changes transparently and offer alternatives or compensations where possible.

- Handling last-minute changes with efficiency can turn challenges into opportunities to showcase your event management skills.

If you do nothing else, be proactive

Considerations:

Identify potential issues early by monitoring social media, review platforms, and on-site feedback, proactively addressing concerns and providing solutions.

How the best event planners do it:

- Proactively monitoring channels allows early detection of brewing issues.

- Address concerns promptly to prevent escalation.

- Taking initiative to resolve problems demonstrates commitment to customer satisfaction and safeguards your event's reputation.

Support Workflow Ideas

Legal Resources

Government Resources

WORKFLOW / USE CASE

Maximising event revenue and profit (workflow example)

Leverage technology and strategic vision to bring together a profound experience for attendees which also drives revenue and profit

Pre-event revenue maximization

Early Bird and VIP Packages:

Entice early registrations with limited-time discounts and exclusive VIP perks, cultivating anticipation and driving early revenue streams.

Bundle Deals:

Incentivize attendees to expand their experience by offering discounted bundles, encouraging participation in multiple sessions or events.

Sponsorship Packages:

Curate attractive sponsorship tiers with diverse benefits, enhancing sponsor visibility and generating pre-event revenue streams.

Merchandise Sales:

Pioneer merchandise sales pre-event, empowering attendees to pre-order and wear branded gear during the conference, bolstering both engagement and revenue.

Early Access Passes:

Foster exclusivity with early access passes to virtual content, fueling excitement and driving revenue through premium offerings.

During revenue maximization

Virtual Booths for Sponsors:

Empower sponsors with virtual booths, granting prime exposure and lead generation opportunities for a fee, maximizing revenue potential.

Upsell Opportunities:

Monetize virtual sessions by offering exclusive upsells like additional resources or consultations, enriching attendee experiences and revenue streams.

Interactive Features for Attendees:

Integrate interactive elements like Q&A sessions and polls, offering sponsorship opportunities that deepen engagement and drive revenue.

In-Person Upsells:

Elevate the in-person experience with premium add-ons like exclusive dinners or VIP access, augmenting revenue streams while enhancing attendee satisfaction.

Gamification with Prizes:

Fuel engagement with gamification and sponsored prizes, encouraging active participation and amplifying revenue through heightened interaction.

Post-event revenue maximization

On-Demand Access:

Monetize post-event content by offering on-demand access to recorded sessions, catering to those unable to attend and extending revenue streams beyond the event.

Extended Networking Opportunities:

Extend networking beyond the event with post-event sessions or forums, offering attendees extended access for a fee, driving post-event revenue.

Access to Resources:

Package and sell event resources like speaker presentations, research papers, and additional materials, providing value and generating post-event revenue.

Membership Programs:

Introduce post-event membership programs for ongoing access to exclusive content and networking opportunities, fostering recurring revenue streams.

Early Bird for Next Event:

Leverage attendee enthusiasm by launching early bird tickets for the next event immediately after the current one, harnessing momentum to drive future revenue.

Profit Maximization Strategies

Optimize Ticket Pricing:

Continuously analyze market trends and adjust ticket pricing accordingly to maximize revenue while ensuring affordability.

Strategic Partnerships:

Form strategic partnerships with industry-related companies for mutually beneficial promotions and shared revenue opportunities.

Data Monetization:

Offer anonymized attendee data to sponsors or partners for market research, lead generation, or targeted advertising.

Premium Content Subscription:

Create a premium content subscription model, where attendees pay a recurring fee for exclusive access to premium content throughout the year.

Post-Event Surveys for Improvement:

Use post-event surveys not only for feedback but also to understand attendees' preferences, enabling more targeted offerings for future events.

Recommended Technology

COMPLIANCE

Pay close attention to your legal obligations and compliance requirements

Protect both organizers and attendees, and mitigate potential event payment risks.

Legal considerations in event payments are crucial to ensure compliance with regulations, protect both organizers and attendees, and mitigate potential risks. They encompass aspects such as privacy laws for secure handling of attendee data, compliance with payment processing standards, creation of robust contracts to define financial arrangements with sponsors and vendors, and adherence to tax regulations for transparent and lawful financial transactions. By prioritizing legal considerations in event payments, organizers can foster trust, prevent legal issues, and create a secure and ethical financial environment for all stakeholders involved.

Legal and compliance considerations with payments and transactions

Privacy and Data Protection:

Implement measures to comply with data protection laws such as GDPR or CCPA when collecting and handling attendee data.

Clearly communicate the event's privacy policy, detailing how attendee data will be used, stored, and safeguarded.

Payment Processing Compliance:

Ensure adherence to payment processing regulations to ensure secure financial transactions.

Comply with Payment Card Industry Data Security Standard (PCI DSS) when handling credit card transactions.

Contracts and Agreements:

Draft comprehensive contracts with sponsors, vendors, and speakers, outlining expectations, deliverables, and compensation.

Ensure contracts cover force majeure clauses and cancellation policies.

Accessibility Compliance:

Ensure event accessibility for individuals with disabilities, adhering to accessibility standards like the Americans with Disabilities Act (ADA) or Web Content Accessibility Guidelines (WCAG).

Insurance Coverage:

Secure event insurance coverage for potential liabilities, cancellations, or unforeseen circumstances.

Ensure insurance extends to both virtual and in-person aspects of the event.

Tax Considerations:

Understand and comply with local and international tax regulations related to event revenue, sponsorships, and financial transactions.

Consult tax professionals to address event-related tax implications.

Cancellation and Refund Policies:

Establish fair cancellation and refund policies for ticket holders and communicate them clearly during the registration process.

Insurance for Virtual Events:

Evaluate whether insurance coverage applies to virtual events, covering issues like technical failures or data breaches.

Online Legal Resources

Serious event planners should embrace all-in-one platforms (like EventsAir).

By consolidating all necessary tools and features into a single platform, event planners can save time and effort that would otherwise be spent navigating between disparate systems. This unified approach enhances efficiency, reduces the likelihood of errors or data discrepancies, and fosters better collaboration among team members.

Benefits for Event Planners & Organizers

Benefits for Event Attendees & Delegates

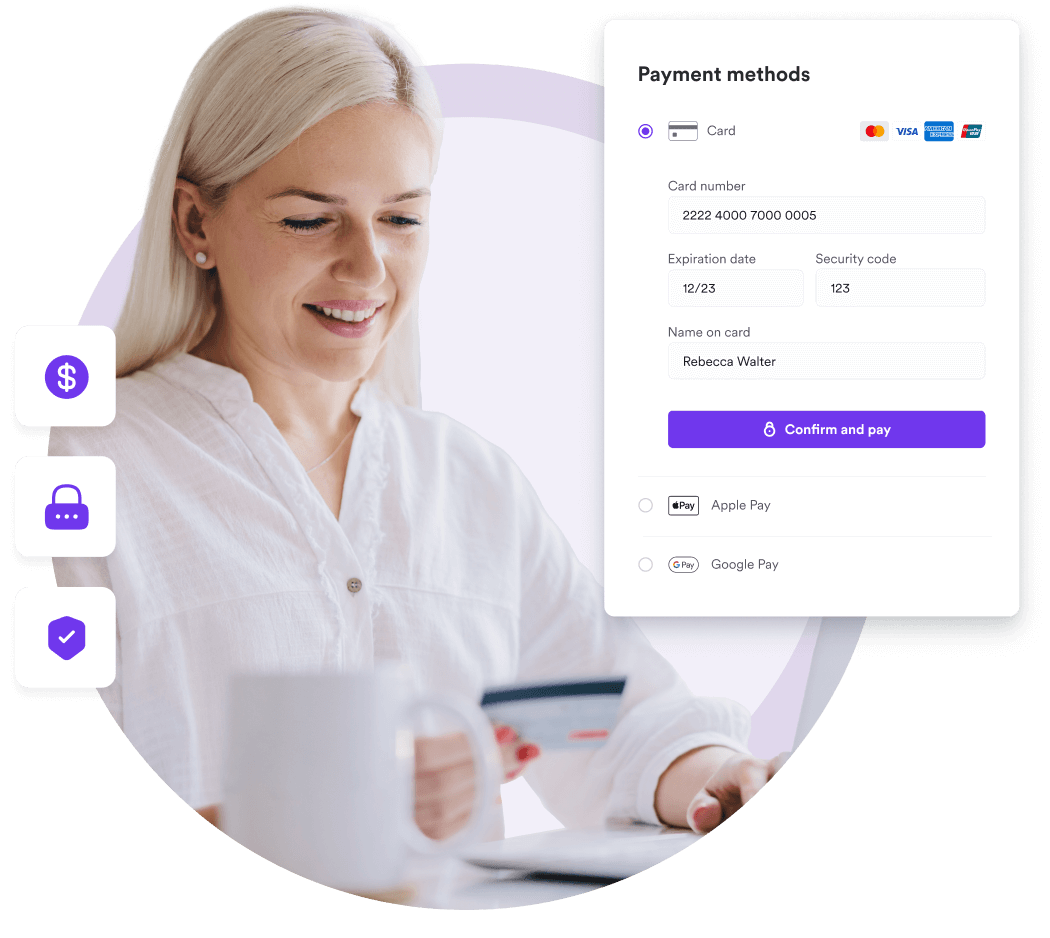

Effortless Financial Transactions with Integrated Payments:

Our platform offers attendees a seamless and contactless transaction experience through integrated payment gateways, accelerating the payment process and aligning with current health and safety preferences to reduce the need for physical contact.

Secured Payment Transactions:

Our software's payment gateways prioritize the security of financial data, ensuring the protection of attendees' sensitive information. This commitment to data security builds trust among attendees, providing a secure environment for utilizing digital payment methods throughout events.

Streamlined Refund Procedures:

In cases of cancellations or refund requests, our integrated payment gateways automate and streamline the refund process within the Event Management Software. This efficiency contributes to attendee satisfaction, offering a hassle-free financial experience even in unforeseen circumstances.

Choose an event management platform? Here's a decision framework which will help you on your journey.

| Cost | Considerations |

|---|---|

| Subscription | Compare subscription fees for each Event Management Software (EMS). Analyze pricing tiers and features included in each plan. Project costs based on the expected number of events and attendees. |

| Fees | Evaluate integrated payment processing fees for each EMS. Compare against the projected volume of transactions. Consider any tiered pricing or discounts based on transaction volume. |

| Costs | Assess upfront or set-up costs associated with each EMS. Consider ongoing maintenance fees and any hidden charges. Look for transparent pricing structures. |

| International | Investigate additional charges for international transactions. Evaluate the impact on overall costs, especially if events are global. |

| Risk | Considerations |

|---|---|

| Security | Evaluate encryption and tokenization features to secure payment data. Assess compliance with industry standards (PCI DSS, GDPR, etc.). Consider the robustness of the security infrastructure. |

| Data | Research the EMS providers' history of data breaches or security incidents. Analyze how they responded and implemented improvements. Prioritize platforms with a clean security track record. |

| Reliability | Assess the reliability of each EMS in terms of system uptime. Investigate their history of glitches or downtime during peak periods. Choose a reliable platform to ensure seamless event management. |

| History | Opt for an EMS with a proven track record in the industry. Look for customer reviews, testimonials, and case studies. Consider the longevity and reputation of the provider. |

| Impact | Assessments |

|---|---|

| UX | Assess the user experience for both organizers and attendees. Evaluate the ease of event setup, registration, and payment processes. Consider any customization options for a branded experience. |

| International | Evaluate how well the EMS handles international transactions. Check currency support, language options, and global payment methods. Ensure a seamless experience for participants worldwide. |

| Branding | Check if the EMS allows for custom branding of event pages and payment interfaces. Ensure consistency with your organization's branding and aesthetics. Consider the impact on the overall event experience. |

| Scale | Select an EMS that can scale with the growth of your events. Evaluate the ability to handle an increasing number of attendees. Consider future features and integrations that may be needed. |

| Effort | Investment |

|---|---|

| Integration | Evaluate the time and effort required for integration with your existing systems. Consider the ease of API integration and compatibility with other tools. Opt for an EMS with a streamlined integration process. |

| Support | Assess the level of support offered during the integration process. Consider the availability of training resources for your team. Ensure there is responsive customer support for troubleshooting. |

| Launch | Evaluate the estimated timeline for implementing the EMS. Consider the impact on your event schedule and deadlines. Opt for a solution with a reasonable and achievable implementation timeline. |

Let's take an objective look at event management platforms (not specifically EventsAir)

The Benefits

- Event management platforms streamline processes, automating tasks such as registrations and payments, saving time and reducing the risk of errors.

- Platforms integrate with multiple payment gateways, providing attendees with diverse payment options for enhanced convenience.

- Reputable platforms prioritize data security and compliance with industry standards like PCI DSS, ensuring a secure environment for financial transactions.

The Risks

- While offering convenience, event management platforms come with associated costs, which might be perceived as a drawback, especially for smaller events with limited budgets.

- The sophisticated features of event platforms may require users to navigate a learning curve, potentially causing initial challenges for those unfamiliar with the system.

- A reliance on technology means that event planners are vulnerable to disruptions such as technical issues, outages, or system updates, impacting the seamless execution of events.

EventsAir Popular Features

Explore the EventsAir Platform

What is EventsAir Pay?

Taking registrations and accepting payments should be easy, simple, and secure. That is why we have built EventsAir Pay – our seamlessly integrated solution for all of your payment needs.

No more third-party payment hiccups – we're here with top-notch support, diverse payment options, ironclad security, and hassle-free global remittance.

"We have nothing but praise for EventsAir."

They were partners in the truest sense of the word. Everything that we asked them to do they were able to do. They went above and beyond the call of duty.

Andy Rice

Chief Operating Officer at MEI

Discover EventsAir Pay today

No more third-party payment hiccups – we're here with top-notch support, diverse payment options, ironclad security, and hassle-free global remittance.

EventsAir Pay is here for all of your payment needs.